newport news property tax rate

Property Tax Rates of Newport NH. 673 Harpersville Road Newport News VA 23601.

How Does Virginia Beach Compare To Other Hampton Roads Cities Vbgov Com City Of Virginia Beach

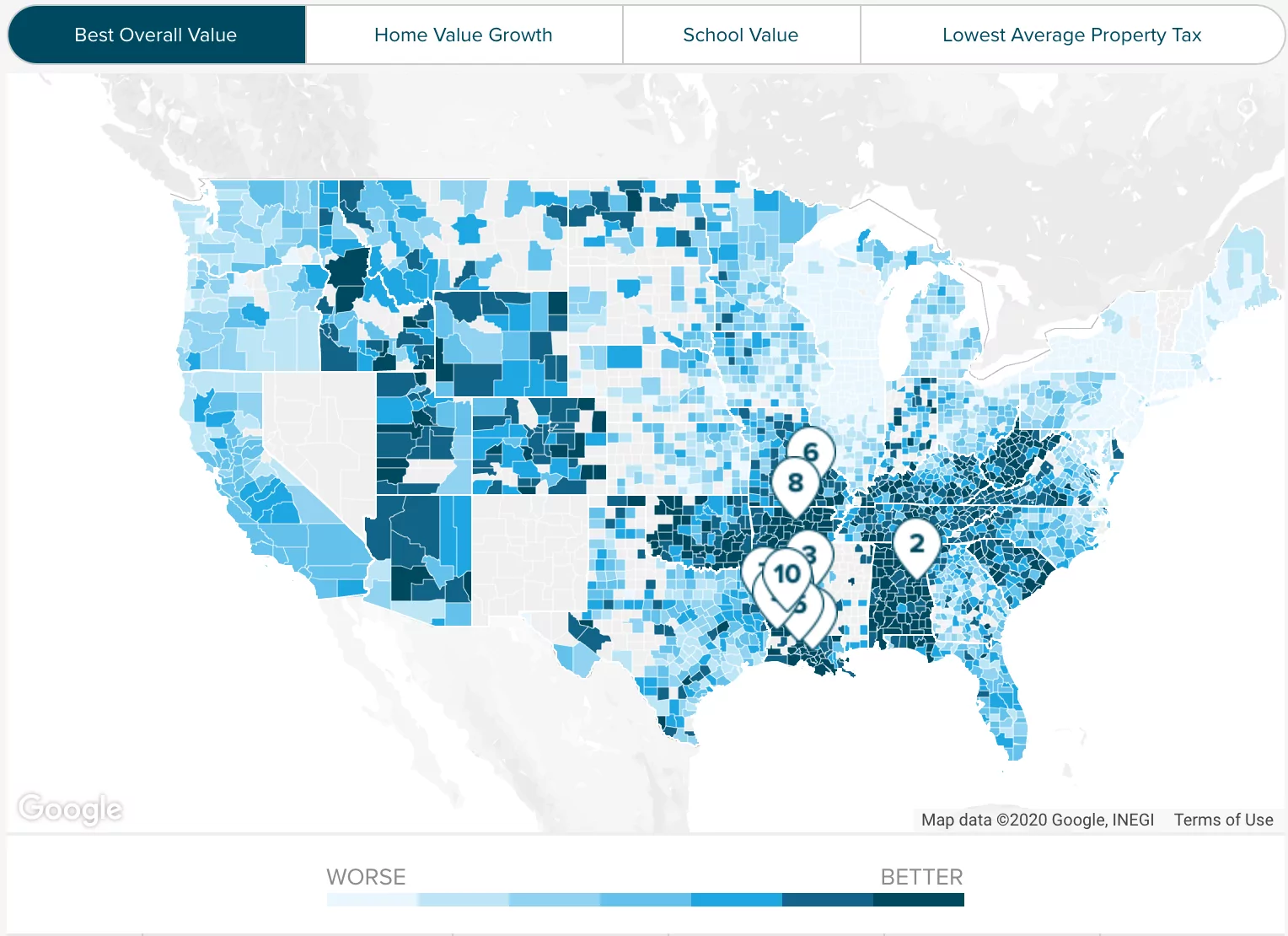

Newport News city collects relatively high property taxes and is ranked in the top half of all counties in the United States by.

. Tangible Personal Property is also assessed annually at fair market value as of December 31st. 757-247-2628 Department Contact Business. Commishnnvagov Hours of Operation 830AM - 430PM.

Newport News City collects on average 096 of a propertys assessed fair market value as property tax. The current real estate tax rate for the City of Newport News is 122 per 100 of your propertys assessed value. Also if it is a combination bill please include both the real estate tax amount and stormwater fee amount as a grand total for each tax account number.

Real Estate Assessors Office 700 Town Center Drive Suite 220 Newport News VA 23606 Hours Monday - Friday. Newport News VA 23607. 757-247-2500 Freedom of Information Act.

401 845-5300 M-F 830 am - 430 pm. The December 2020 total local sales tax rate was also 6000. The city councils in Hampton and Virginia Beach have also voted to reduce the assessment ratio by 25.

Furniture Fixtures and Equipment are taxed at the commercial rate. Norfolk is providing relief by waiving its vehicle license fee for the 2022 year to save taxpayers roughly 5 million a year in fees. WAVY Newport News City Council has signed off on lowering the real estate tax rate for the first time in 14 years.

City Council met Tuesday night and voted unanimously to. 75 plus sales tax The tax on the first 20000 of the assessed value of qualified personal property will be reduced for tax years 2006 and forward. 0 2016 54 Loudon La.

More ways to connect. Tax Rates for the 2019-2020 Tax Year. Whether you are already a resident or just considering moving to Newport News County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

When you use this method to pay taxes please make a separate payment per tax account number. Downtown Office 2400 Washington Ave. Refer to the Personal Property tax rate schedule for current tax rates.

Top Property Taxes Morrison. If you have a specific question regarding personal property tax please consult our Personal Property FAQ or call the Treasurers Office at 757-926-8731. It is divided into two parts.

Newport News VA 23607 Phone. How Newport News Real Estate Tax Works. Property Assessment Search Access Terms Conditions Disclaimers.

This rate includes any state county city and local sales taxes. This is the only property tax bill that will be mailed. Scroll down to learn about how we determine the taxable value of property.

The assessed value multiplied by the real estate tax rate equals the real estate tax. Newport News City has one of the highest median property taxes in the United States and is ranked 506th of the 3143 counties in order of. City of Newport News Department of Development.

You have several options for paying your personal property tax. 50 plus 1 local option. If you retain the plates after you have transferred from the area you will be responsible for any taxes that have accrued or will accrue once you leave the area.

Still taxpayers generally receive a single combined tax bill from the county. Newport News VA 23607. 8 AM - 5 PM Questions.

Learn all about Newport News County real estate tax. The latest sales tax rate for Newport News VA. If you would like an estimate of the property tax owed please enter your property assessment in the field below.

The median property tax also known as real estate tax in Newport News city is 190100 per year based on a median home value of 19850000 and a median effective property tax rate of 096 of property value. Utilities Bills are sent quarterly Utilities are due March 15th June 15th September 15th and December 15th. Receipts are then dispensed to related taxing units via formula.

Businesses registered in Newport RI are taxed for the PREVIOUS calendar year ie. 2020 rates included for use while preparing your income tax deduction. The bills explain that all taxes not paid by the final due date become delinquent with an 8 penalty and a 1 interest per month added to late payments.

Including data such as Valuation Municipal County Rate State and Local Education tax dollar amounts. What are the property taxes in Newport NH. The states give property taxation rights to thousands of community-based public entities.

Retail Inventory is taxed at a different retail inventory rate. Tiffany Boyle Commissioner of the Revenue Biography For General Inquiries. Personal Property Tax vehicles and boats 450100 assessed value.

43 Broadway Newport RI 02840 Phone. 2020 tax bills are for active businesses during the 2019 calendar year. 757-247-2500 Freedom of Information Act.

The 104 billion budget proposes dropping the real estate tax rate by 2 cents to 120 per 100 of assessed property value. You have an active business if you have not properly closed your business by either closing with the Assessors office in person or by filling out the Close of Business form by mail. Newport News VA 23607 Phone.

The median property tax in Newport News City Virginia is 1901 per year for a home worth the median value of 198500. Newport News VA 23607 Main Office. NEWPORT NEWS Va.

Our Current Tax Rate View Newports current Tax Rate on real estate and motor.

Property Tax Pakistan In 2022 House Artificial Grass Artificial Grass Installation

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Find Your Desired Property Across Pakistan Online Ocean View Apartment House Styles Renting A House

Fbr Capital Gain Tax On Property In Pakistan 2021 22 In 2022 Property Finding Yourself Capital Gains Tax

Finding Your Next Home Could Be Just A Click Away Call Me To Get Started Tami Savage Florida Flori Next At Home Waterfront Homes For Sale Finding Yourself

New Free Stock Photo Of Hand Pen Writing Tax Guide Inheritance Tax Tax Deductions

Appealing Your Property Taxes Consider Expert Help Tax Attorney Property Tax Tax

Living In Bainbridge Island Wa In 2022 Bainbridge Island Bainbridge Island

The Legal Guide To Buying A Property Infographic Infographic Law Firm Legal

Riverside County Ca Property Tax Calculator Smartasset

Timbrohomes 5 Expenses Homeowners Overlook California Real Estate Homeowner Real Estate Trends

Property Tax City Of Commerce City Co

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Ex Investment Property Budget Spreadsheet Being A Landlord

Tax On Immovable Property In Pakistan In 2022 Ocean View Apartment Property Beach Apartment

Many Left Frustrated As Personal Property Tax Bills Increase

Property For Sale In Skardu Pakistan In 2022 Property For Sale Property Ocean View Apartment